Amazon Fba Which Tax Report Do I Use for Taxes

So if you want to send individual products into FBA you would need to use the old method. Amazon will automatically have a 1099-K form filed out for you by their payment.

How To Setup Amazon Sales Tax Settings Amazon Marketing Amazon Tax Amazon Fba Seller

Currently the Send to Amazon beta only allows you to create shipments for case-packed products.

. There often seems to be a lot of confusion about Amazon FBA taxes that stems from the 20k rule This rule means that all sellers who use marketplaces such as Amazon and make more than 20k of unadjusted gross sales or have more than 200 transactions must report Amazon sales on their taxes. Non-collecting seller use tax reporting. Another problem that we see Amazon sellers run into is they hire a tax accountant but then try to save time by DIYing their bookkeeping or having their VA do it.

Recently Amazon introduced a new Send to Amazon beta which is a three-step shipment creation workflow to set up your FBA shipments. Unless you were an accountant or bookkeeper before you started your FBA business you probably dont want to spend time on bookkeeping each month. Plus this is time you could be spending growing your.

From January 1 2018 to June 30 2019 non-collecting marketplace facilitators remote sellers and referrers selling their own goods that have between 10000 and 100000 in Washington gross receipts in the current or preceding calendar year are required to notify customers about their potential use tax liability provide customers with an.

Helpful Sales Tax Steps For Amazon Fba Sellers Sales Tax Amazon Fba Business Tax Return

Some States Have Complicated Filing Requirements Like California Filing Taxes Sales Tax Tax

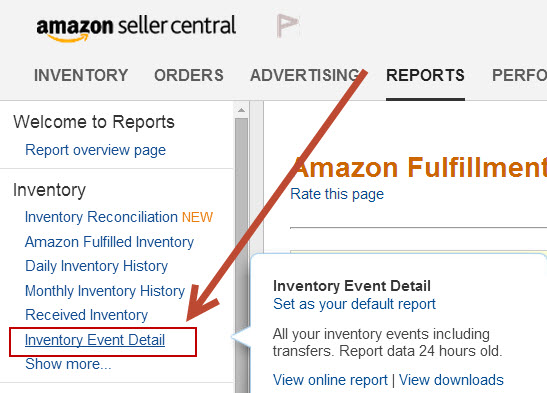

How To Run End Of The Year Inventory Sales Reports For Tax Purposes Full Time Fba Amazon Fba Business Fba Inventory

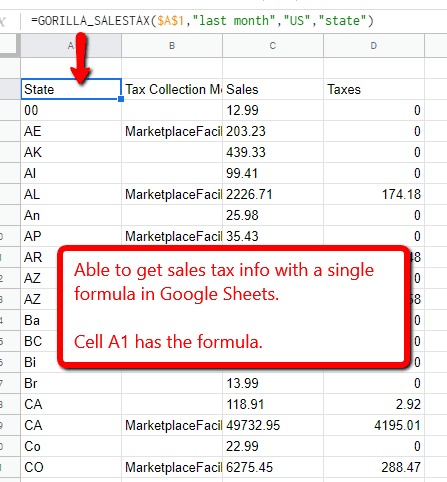

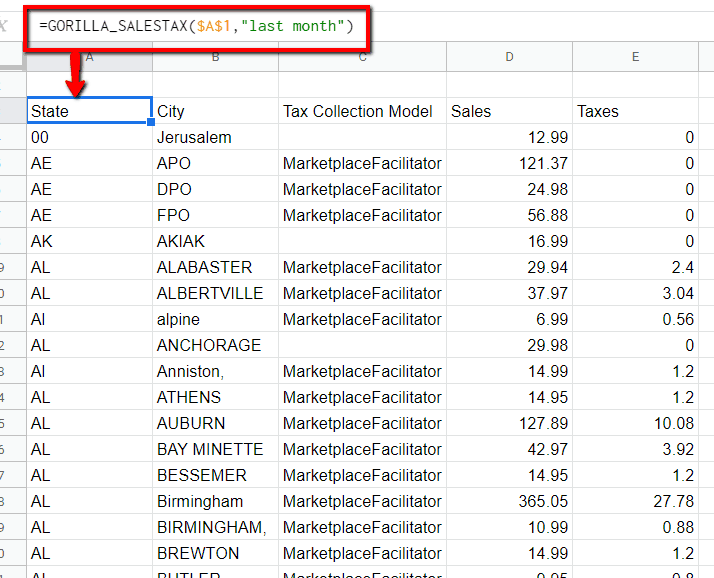

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

How To Find The Total Fees Paid To Amazon For Filling Taxes With Your 1099 K The Selling Family Amazon Fba Business Amazon Fba Amazon Fba Seller

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

Amazon Fba And Mf Sales Monthly And Expenses Profit Google Etsy Excel Spreadsheets Profit And Loss Statement Amazon Fba

Missing These Tax Deductions Means Missing Out On Money Tax Deductions Tax Help Deduction

Amazon Fba Sales Tax And Nexus Information Passion Into Paychecks

How To Download Your End Of Year Inventory For Amazon Fba And Your Cpa Or Yourself For The Irs Tax Filing Taxes Am Filing Taxes Business Planner Inventory

How To Find Where Amazon Fba Gives You Sales Tax Nexus Taxjar

Amazon Fba Tax Filing What You Need To Know Sageseller

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

How To Report A Seller On Amazon And Fight Hijackers Who Steal Or Piggyback On Your Listing Make Money On Amazon Piggybacking Amazon Fba

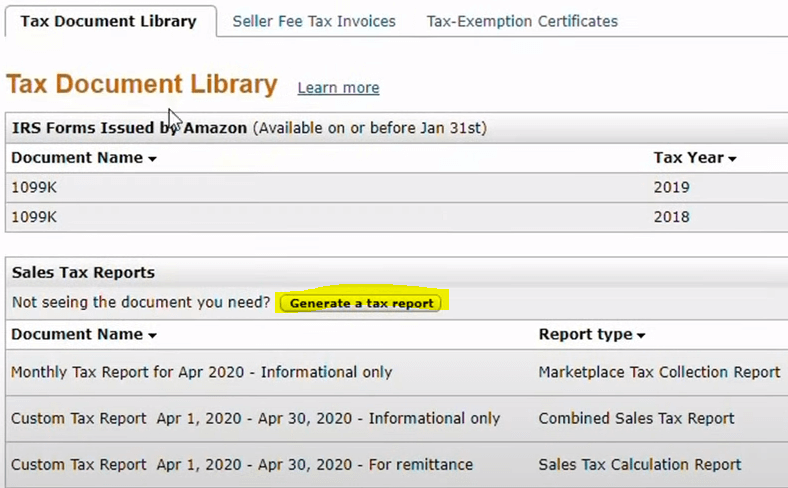

How To Find And Understand Your Amazon Sales Tax Report

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

Amazon Tax Reporting Filing Taxes For Sellers In 2022

How To Do Taxes For Amazon Fba Amazon Sales Tax Vat E Commerce Taxes Explained Youtube

Comments

Post a Comment